[Company news] Vinh Hoan CEO: Value-adding is key for pangasius market recovery

20 October 2017

Rising prices, ‘fake news’ and increasing competition from other species are just a few of the challenges pangasius suppliers faced last year.

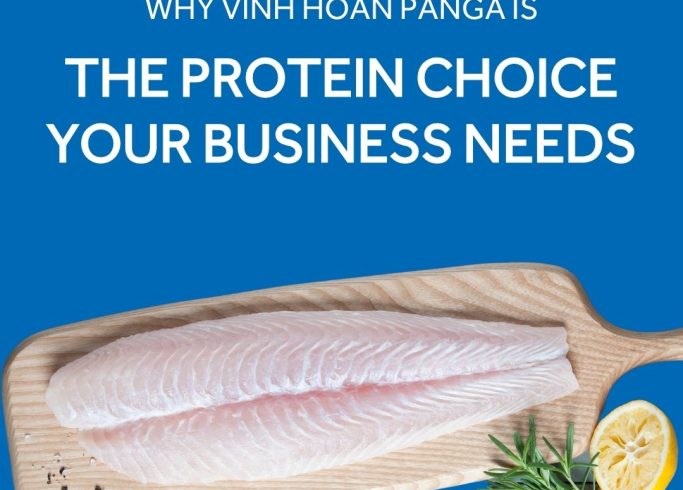

Vietnam’s pangasius sector is crawling out from under a”turbulent year.” Tam Nguyen, CEO at producer Vinh Hoan, told IntraFish.

Rising prices, reputational issues in Europe, increasing competition from other whitefish such as pollock and new inspection rules in the United States created an unfavorable mix for the country’s suppliers, she said.

Vinh Hoan is now looking to increase its focus on adding value to the species and is hoping to increase the turnover share of that segment of its business from its current 3 percent to 10 percent within two years.

“The biggest investment for us was in value-added production”, Nguyen said.

Vinh Hoan is now producing “fully-cooked” fish with a sauce – kabayaki style – for the Japanese market. Nguyen is expecting further growth opportunities there, as well as in China and Europe.

“For the last 10 years this industry has produced around 1.1 to 1.2 million metric tons [globally] but the potential for fish is very big, especially for adding value,” she said. “Pangasius goes well with different ingredients and flavors and can have a very important role in the market if we do it right.

“I think we could grow up to 2 million tons of production within the next five years,” she said.

Europe a struggle

The market in Europe was a particular struggle this year, Nguyen said, and very much so in Spain, where a raft of negative media reports resulted in a public outcry at the beginning of the year. The biggest hit came when retailer Carrefour pulled the fish from its stores in Spain, Belgium and Italy.

Exports to Spain dropped by as much as 45 percent as a consequence, while Vietnamese exports to Europe fell between 20 percent and 25 percent, Nguyen told IntraFish.

This “bad reputation” coupled with the high prices “is not a good situation,” she said.

A number of communication and public relations initiatives are now in progress, led by the Vietnam Association of Seafood Exporters and Producers (VASEP).

However, the group has limitations, and Nguyen is calling again for a “more effective” marketing mechanism.

“The industry in general should be more proactive and more prepared, otherwise we’ll always be vulnerable to fake news,” she said.

The company is also seeing increasing competition from other whitefish such as pollock in the fillet category at European retailers.

“The competition has been tough but it’s still worth promoting the category,” she said.

High prices squeezing margins

Nguyen said she doesn’t expect an increase in Vinh Hoan’s profit margins this year because of higher raw material costs.

“We’ll have a turnover growth due to the higher cost of raw material. But we couldn’t pass on the price increases to customers,” she said.

Prices started to increase after unfavorable weather last September and October, resulting in a shortage of fingerlings.

They peaked in May and then dropped off in June and July, before rising again.

“We expect them to remain strong until January,” Nguyen said. “We’ve never had such a severe and long-lasting price surge, and it was the first time ever prices were so high.”

Extracted from Vinh Hoan CEO’s phone interview with Intrafish’s reporter.