[Industry news] Vietnam’s Shrimp and Pangasius Companies Struggling with High Interest Bank Loans

29 May 2017

[Reposted from Urner Barry, please find the original article here. We are not in anyway responsible for the content of this post]

According to experts, there are many reasons leading to the hard time of seafood sector in recent years. Some of them are technical barriers, trade protection and quality control regulations of import markets, raw materials for processing, etc.

Some believe that the competitiveness of products in the industry is declining. The dong/US dollar exchange rate which was adjusted to be much lower than that of other exporting countries has made Vietnam’s agricultural and seafood products of the same kind become more expensive.

However, these are part of the cause for the decline of the fishery group. Financial reports of many seafood businesses on the stock market are showing a painful situation that debt and bank loans “have eaten up” these businesses’ profits.

For investors, a business will be appreciated when it knows how to use external resources effectively. In particular, the mobilization and use of bank loans showed the sharpness and management capacity of the leadership. This can be shown in a high ROE.

However, that theory does not seem appropriate to the Vietnamese market because of unpredictable interest rates. The risk is huge when the business plan is diverted.

It is noteworthy that most seafood businesses have been stranded due to rising interest rates since the economic crisis associated with asset bubbles in 2008.

Lending rates in those periods were sometimes over 20-25 percent, causing swings in loans to manufacturing firms.

For example, Ca Mau Frozen Seafood Processing Import Export Corporation (CMX), known as the “ecological shrimp king”, had experience its golden age since 2007. However, from 2011 onwards, the sharply-increasing interest payment made this business fall into difficulties. In 2011, CMX had to pay financial expenses of more than 100 billion dong, of which interest was 77 billion dong, resulting in profit falling from 44 billion dong to four billion dong in 2011.

CMX’s report of the first quarter 2017 showed that with both short and long-term loans of up to 450 billion dong at banks, CMX made one dong of profit, the bank would also earn one dong.

Similar to CMX, An Giang Fisheries Import Export Joint Stock Company (AGF) has also been in debt for many years. Despite the revenue of approximately three trillion dong per year, the financial expense of more than one hundred billion dong in 2011 made AGF fall into difficulty. AGF’s debt did not reduce but doubled compared to five years ago while revenue did not increase, which led to losses.

Even for the industry leaders which have much capital advantage and invest heavily in the value chain, the situation is not very good.

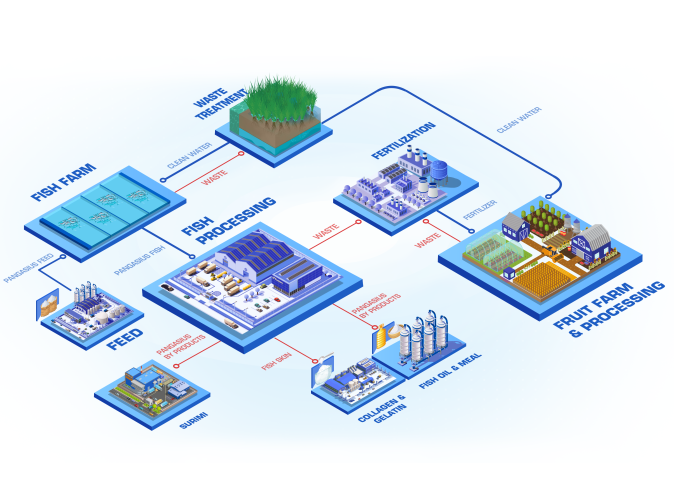

The most typical evidence is the case of Hung Vuong Corporation (HVG), considered as “King of pangasius” in Vietnam after a series of M & A. Hung Vuong almost finished the closed chain from the seed, food, private farming areas, processing plants and cold storage systems, etc. However, with the debt burden of over eight trillion dong, HVG’s interest has increased over the years. In 2016, the company’s financial expenses amounted to 577 billion dong, of which 480 billion dong was interest, leading to a loss of 49 billion dong.

Obviously, quick or slow repayment of loans is highly dependent on business operations. If the market is not favourable, the pressure from bank loans and loans to Hung Vuong is not small.

Even for Minh Phu shrimp king could not breathe easily in the period from 2015 to now. With the debt of up to 6.355 trillion dong, 2.8 times higher than equity, Minh Phu’s financial expense in 2015 was 440 billion dong, accounting for 41 percent of gross profit. The profit after tax was 32 billion dong, which was a very small amount compared to the revenue of 12.5 trillion dong.

According to the 2017 semi-annual financial report of Hung Hau Agricultural Corporation (SJ1), the interest of the corporation is higher than the profit. On the other words, the company made 10 billion dong of profit, banks got 17 billion dong.

It can be seen that businesses that invested in expansion by borrowing instead of equity have become the No.1 slaves for banks in the period of high interest rate.

However, it can be seen that if these businesses had been more cautious in financial planning, they might not have fallen into such a situation because an export business with a good business situation, solid asset structure and low leverage, banks are more likely to lend at favourable rates.

The evidence shows that businesses in the same industry which have less debt is living healthily, even with good growth. For example, the case of Vinh Hoan Corporation (VHC), which is smaller in size than Minh Phu and Hung Vuong, shows the firmness of a business that chooses a slow path.

Except for the profit slump in 2011, VHC’s revenue and profit have continued to grow in recent years, despite the industry’s overall difficulties. In 2016, VHC got 7.303 trillion dong in revenue and 567 billion dong in profit after tax, the highest in the fisheries sector. VHC expects revenue of 12 trillion dong in 2019 with an annual average growth of 15 percent and after-tax profit of one trillion dong in 2019.

Ben Tre Aquaproduct Import Export Joint Stock Company (ABT) and Sao Ta Foods Joint Stock Company (FMC) did not have a strong growth such as VHC but still maintained a good profit in recent years thanks to borrowing with low interest rates.

![Demystifying Pangasius: Debunking Common Myths and Misconceptions 3 41 [All in Fillets] 2901 1 HIGH](https://www.vinhhoan.com/wp-content/uploads/2024/06/41_All-in-Fillets-2901-1-HIGH-683x490.jpg)